So we've talked about goals. We've talked about the plan of attack. And now we need all the help we can get. Short of posting our address so that y'all can send all your extra cash our way, here are some things that have been helpful/motivational/educational thus far:

Budget Bytes/meal planning: As you know, I cook most every night and do so from a weekly menu. I don't need to rehash the details for you {you can find them here}. Meal planning in and of itself helps save quite a bit of money and it certainly did so for us when I first started on our meal planning journey 2.5 years ago. But now we need to me more aggressive. Budget reduction has forced me to do two things: have up to the minute knowledge of what's in our pantry/fridge/freezer and hunt for more inexpensive recipes that are still healthy and fall in line with our food values.

Enter the Budget Bytes website. You may have noticed that a LOT of my Menu Monday recipes as of late have come from her website. There are so many delicious ideas and they're all realistic and wallet-friendly. I still use my other usual recipe sources, but I have to analyze them more closely to make sure they fit within our grocery budget. The good news is that the budget reduction has helped me in my goal to reduce our meat consumption. Meat ain't cheap!

Any other websites or resources for real food {i.e. no packaged, processed junk} recipes on a budget?

Dave Ramsey's website: While we have no plans to enroll in any FPU classes or purchase any of the materials, there is a wealth of information on Dave Ramsey's website that is available for free. Information on the cash envelope system, the seven baby steps, home buying, and more is there for the taking. Honestly, I haven't even scratched the surface with the available information.

Nancy Ray's website: I found Nancy's website through Em for Marvelous and it's been very inspirational. This post in particular has links to resources they found to be helpful.

Excel: OMG this would NOT be possible without my handy dandy Excel spreadsheet. I have one document for our budget. There is a different worksheet for each month. Each worksheet is broken down into the following categories: Fixed Expenses, Minimum Credit Card Payment, Envelopes, Debt Pay-Off, and Income. Depending on any special circumstances that month, there may also be columns for Gifts {even though the money is coming out of the Gifts envelope, I use these columns to budget exactly how much to spend on each gift} or Travel or, like this month, M's Parking Tickets. At the bottom of each spreadsheet I have what our total amount of debt is at the beginning of the month. That helps me keep an eye on the big picture. I get a really sick pleasure out of updating my little Excel workbook. I love it.

One thing that hasn't worked: envelopes. Not to be confused with the Envelope System. Since this is our first month and it seemed a little contradictory to purchase a special wallet for a system that's supposed to help us STOP spending money, I just used plain ole paper envelopes. FAIL. This worked for M's envelopes {he has one for his gas money, one for his fun money, and he has the one for pet supplies} because he just keeps them locked in his car. For me, it just meant that I had loose change falling out into the bottom of my purse. Disaster. It caused some serious stress in the check-out line at the grocery store last week. I'm going to have to get me one of these pretty little things to help with the organization.

So that wraps up our money talk for the week! I'd love to know what resources have been helpful to those of you workin' your family budgets. I get distracted easily, so I need mucho assistance in staying on task during our journey to being 100% debt-free. I'll be checking in periodically on our progress, mainly when we've crossed something off the checklist or hit a major milestone. We're hoping to reduce our total debt by 10% by the end of this year. Fingers crossed!

Showing posts with label 101 in 1001. Show all posts

Showing posts with label 101 in 1001. Show all posts

16 May 2013

Summer Slimdown Part III

Labels:

101 in 1001,

de-debting,

finances,

food,

goals,

healthy living,

marriage,

menu monday

15 May 2013

Summer Slimdown Part II

Growing up I was told that it wasn't polite to talk about politics, sex, or money. We're not talking politics or sex today {you're welcome, Mom}, but we are continuing our chat about money. I realize there are some of you who find this mind-numbingly boring, but I love, love, LOVE reading about the way other people, especially people my age, manage money. It's the financial equivalent of peeking into someone's medicine cabinet.

It's a little {maybe a lot} scary to be talking about our finances in such detail on here. Money is such a private thing and it's not something I sit around discussing with anyone other than M. But I'm hoping through sharing our experience and our goals that this will provide some accountability and support. I'm such a typical fire sign. I'll make a plan and have goals and get all pumped up for them and then a month later I'm totally off the bandwagon. Maybe the fear of public shaming will help me get back on board when we inevitable fall off.

So. When we left off yesterday, I was talking about how the hard part of all this is turning all of our exciting goals and dreams into plans and actions. The first thing I did was pretty basic: add up how much comes in each month and add up how much goes out. I added up all of the obligatory recurring expenses {rent, utilities, gas, car payments, student loan payments, car insurance, cell phone bill, etc.} and put them into one category. Minimum monthly credit card payments were added up and put into another category. Then comes the new part: the envelope system.

I vaguely remember my parents using the envelope system at one point in my childhood and I know I've seen other bloggers {the Duchess of Fork comes to mind} who use it. But it wasn't until I read Emily's guest post from Nancy that I thought, "Hey, we can do that!". And do that we did.

We are half way through our first month of the envelope system. I can already see that I'm going to need to make some adjustments {I under budgeted for a number of items}, but that's OK. We'll make the necessary changes and try again next month. Most everything I've read says that it takes a few months to really get the hang of it, so perseverance is the name of the game. I have to say, it is REALLY strange to be carrying around so much cash and see the resulting teeny tiny balance in our checking account. It's unsettling, especially because I rarely ever carry cash.

Here are the envelopes we have:

Groceries: pretty self-explanatory. Prior to our budget adjustment, we were spending about $400/month on groceries. I cook pretty much every single night, plus we pack our lunches and eat breakfast at home. We rarely eat out, not because we don't like it, but because the only restaurant options in our town are Arby's, McDonald's, and Denny's. I'm challenging myself to go down to $300/month. I'd love to go even lower, but we're taking baby steps.

Pet Supplies: We have two dogs, one of which is on a special diet and medication due to allergies and anxiety. Right now I've got $100/month budgeted, but that may be able to scale down to $80 or $90. We'll see.

Pet Boarding/Vet: Again, pretty self-explanatory. I've got $100/month budgeted for this. Depending on how much we scale back on our traveling, I may be able to trim this to $70/month, but it adds up quickly. Two nights in the kennel for our two boys is $84. This is a rollover envelope, meaning anything that doesn't get spent in a month just stays in the envelope. The idea being that it builds up a back-up to our emergency savings should anything major happen to one of our boys.

Household: This envelope is for things like toilet paper, dish detergent, hand soap, etc. This is outside of our grocery budget, which is new for me. I budgeted $15/month this month, which was not nearly enough, but that was because we ran out of everything at once. This will be a rollover envelope.

Personal Care: This envelope is for haircuts, highlights, body wash, shampoo, toothpaste, make-up, etc. Right now I've only got $25/month budgeted. Some months that will be more than enough, but some months it won't even come close. This one may need to be adjusted, but we'll see. This will definitely be a rollover envelope.

Fun Money: I'm sticking to the diet philosophy that if you deny yourself any and all treats, you're much more likely to crash and burn. I've budgeted a total of $80/month, or $40/each. This may be a bit too generous, so depending on what adjustments need to be made to the other envelopes, this may go down to as little as $50/month.

Date Night: Not negotiable. I see our de-debting plan not only as an investment in our financial future, but in our marriage. Money is a top cause of divorce and we want to be mindful of that, but I don't want to neglect taking care of our relationship as a means to an end. I'm allotting $40/month, so not much more than a pizza night at home and seeing a movie. But this is an important one that I want to try not to cut back on.

Auto Care: This envelope is outside of the money budgeted for gas for our cars. The idea is for this to build up to pay for routine maintenance like oil changes and inspections, as well as a back-up to our emergency savings should anything more major happen with one of our cars.

Gifts: Pretty self-explanatory. I've budgeted $40/month. Some months we'll spend it all {it's already forcing me to be extra creative with our gift-giving occasions this summer!}, some months it will rollover to save up for things like our anniversary and Christmas.

OK, so some people refer to their fun money as blow money. But if I had an envelope for blow, I would assume someone was funding a yet-to-be-discovered cocaine habit. Maybe for some people it's one and the same?

So I add up the recurring expenses, the minimum credit card payments, and the envelopes and subtract the total from our income. Everything else goes to paying down debt.

We have a ways to go to really get the hang of this. I can already tell there are going to be times when it really sucks {i.e. not a lot of built-in $$ for my drive-thru McDonald's Diet Coke habit}, but I can also already tell that it is going to be hugely helpful for us in reaching our goals.

Do any of you use the envelope system or some version of it? As a newbie, I would LOVE any tips/tricks/advice you might have. And if anyone would like to help prettify our envelope system, you are more than welcome to buy this lovely wallet for me :)

Tomorrow is the last financial post of the week {I promise}. I'll be posting the different resources that have been helpful so far...

Labels:

101 in 1001,

A Day in the Life,

blogging,

de-debting,

finances,

goals,

marriage

14 May 2013

Summer Slimdown Part I

A few weeks ago, I mentioned in a recent post that we were cutting back on both calories and spending in our house. Katie commented that they were doing the same and Mr. Perk was referring to it as the Summer Slimdown. I love giving things a title {makes it feel more official and, dare I say, fun?} so I'm stealing theirs! The cutting back on calories is pretty self-explanatory {not-so-subtle plug to come follow me on My Fitness Pal at username GessHoo07!}, but I thought I would share a little more on our budget reduction.

Debt is something we've really struggled with from early on in our relationship. M came into our marriage with no car payment and next-to-nothing credit card debt, but a ton of student loans. I was the opposite; I came in with a car that was half paid for, student loans that were half paid for, and quite a bit of credit card debt. It's something that's constantly hanging over our heads.

Up until recently, I've kind of kidded ourselves into thinking we were relatively financially sound. We make more than enough to pay our bills, we have some emergency savings, and we have quite a bit squirreled away in our retirement accounts. But it always came back to the debt. Inspired by the Em is for Marvelous posts on money, I sat down and took a brutal look at our finances and came up with a strategy and timeline for paying off our debt. Paying off all of our credit card debt was one of my 101 in 1,001 goals, but honestly? Kind of a wimpy goal. Now the goal is ALL debt. The cars {we ended up buying one for M in October so now it's 2 car payments}, the credit cards, the student loans. Every last bit GONE by the time I turn 30, or hopefully sooner.

On our timeline, we should have 3 of the 5 credit cards paid off by September and my car paid off by October. The next hurdle are the remaining 2 credit cards, which carry most of our credit card debt. The plan is to have one paid off by the end of the calendar year and the other one paid off by March 2014. Then we'll tackle my student loans, M's car, and finally his student loans. Once all those are paid off, we plan to build up 3 months of equivalent of our salaries in savings and save for a down payment on a house. Within 5 years, we want to be able to purchase a house on a 15-year fixed rate mortgage and have no other debt.

For those of you paying attention, this kind of loosely follows Dave Ramsey's plan. We're not actually enrolling in any of the classes because A) I feel like I can get enough of the information online to figure out a plan for us and B) I don't need any preaching alongside of our debt diet.

Still with me? I know many people's eyes roll to the back of their heads when anyone starts number crunching, but I absolutely LOVE this stuff. Comes with the territory when both of your parents are accountants.

Talking about our goals is really fun and exciting. You may daydream of tropical vacations and handbags, but I daydream of being totally debt-free with bank accounts busting at the seams from lots of savings. {OK, I dream about the handbags and vacations too.} The hard part is actually changing our spending patterns and habits and putting plan into action. To be continued tomorrow...

Debt is something we've really struggled with from early on in our relationship. M came into our marriage with no car payment and next-to-nothing credit card debt, but a ton of student loans. I was the opposite; I came in with a car that was half paid for, student loans that were half paid for, and quite a bit of credit card debt. It's something that's constantly hanging over our heads.

Up until recently, I've kind of kidded ourselves into thinking we were relatively financially sound. We make more than enough to pay our bills, we have some emergency savings, and we have quite a bit squirreled away in our retirement accounts. But it always came back to the debt. Inspired by the Em is for Marvelous posts on money, I sat down and took a brutal look at our finances and came up with a strategy and timeline for paying off our debt. Paying off all of our credit card debt was one of my 101 in 1,001 goals, but honestly? Kind of a wimpy goal. Now the goal is ALL debt. The cars {we ended up buying one for M in October so now it's 2 car payments}, the credit cards, the student loans. Every last bit GONE by the time I turn 30, or hopefully sooner.

On our timeline, we should have 3 of the 5 credit cards paid off by September and my car paid off by October. The next hurdle are the remaining 2 credit cards, which carry most of our credit card debt. The plan is to have one paid off by the end of the calendar year and the other one paid off by March 2014. Then we'll tackle my student loans, M's car, and finally his student loans. Once all those are paid off, we plan to build up 3 months of equivalent of our salaries in savings and save for a down payment on a house. Within 5 years, we want to be able to purchase a house on a 15-year fixed rate mortgage and have no other debt.

For those of you paying attention, this kind of loosely follows Dave Ramsey's plan. We're not actually enrolling in any of the classes because A) I feel like I can get enough of the information online to figure out a plan for us and B) I don't need any preaching alongside of our debt diet.

Still with me? I know many people's eyes roll to the back of their heads when anyone starts number crunching, but I absolutely LOVE this stuff. Comes with the territory when both of your parents are accountants.

Talking about our goals is really fun and exciting. You may daydream of tropical vacations and handbags, but I daydream of being totally debt-free with bank accounts busting at the seams from lots of savings. {OK, I dream about the handbags and vacations too.} The hard part is actually changing our spending patterns and habits and putting plan into action. To be continued tomorrow...

Labels:

101 in 1001,

A Day in the Life,

de-debting,

finances,

goals,

marriage

11 April 2013

Denim, Denim Everywhere

I have a complicated relationship with jeans. I want to love them. They just seem so timeless. Jeans never go out of style, you always read in terrible magazines that men find women sexiest in a pair of jeans, the right pair can go from day to night, yada yada yada. I've just never been able to find that magical pair. I feel like my girlfriends have these religious experiences where they put on a pair of jeans and they look 5 lbs skinnier and their legs look 3 miles long and their butt looks like circa-2001 Britney Spears. No pair of jeans has ever done any of those things for me.

It may be because I've never bought a pair of designer jeans. I know, I know. Everyone says that they're the way to go. But when designer jeans first came around again, they simply did not offer them in lengths/inseams for us shorties. And you cannot hem jeans more than 1/2-1 inch without ruining the look. The only jeans I've owned for the past 6 years have all been from Old Navy and meh. They weren't AWFUL, but they certainly weren't flattering and they most DEFINITELY did not make me look sexy. At all. And then a fellow blogger {I think it was Kate at Nautical by Nature?} posted this article about Gap and Old Navy mom jeans. Suddenly it all made sense! I was buying the wrong jeans!

I got rid of all my jeans {I hardly ever wore them anyways} and swore I would buy new ones....yeah, that part never happened. But armed with research, I'm ready for a denim bonanza. The hunt for the perfect pair. Here are the top recommendations:

It may be because I've never bought a pair of designer jeans. I know, I know. Everyone says that they're the way to go. But when designer jeans first came around again, they simply did not offer them in lengths/inseams for us shorties. And you cannot hem jeans more than 1/2-1 inch without ruining the look. The only jeans I've owned for the past 6 years have all been from Old Navy and meh. They weren't AWFUL, but they certainly weren't flattering and they most DEFINITELY did not make me look sexy. At all. And then a fellow blogger {I think it was Kate at Nautical by Nature?} posted this article about Gap and Old Navy mom jeans. Suddenly it all made sense! I was buying the wrong jeans!

I got rid of all my jeans {I hardly ever wore them anyways} and swore I would buy new ones....yeah, that part never happened. But armed with research, I'm ready for a denim bonanza. The hunt for the perfect pair. Here are the top recommendations:

In all fairness, there is still a pair of Gap jeans in this mix {#7}. But multiple people recommended checking them out, so I'll give them a shot. There is also a pair of Banana Republic jeans in there {#5}, as 3 different people recommended them. The picture from the website is hideous, so let's hope they're a bit more impressive in person. I have high hopes for the Levis {#3 and 4}. They are super inexpensive, have great reviews, and look quite stylish in the pictures. Then there are the 3 extra $$$ fancy designer pairs {#1, 2, and 6}. I'm not trying them until I've tried all of the others. That way, if I end up spending that much on a pair of jeans, I can say I tried everything.

Several people recommended the J.Crew toothpick and matchstick jeans. People either love them or hate them, which I find to be true of all J.Crew pants. In the past, their jeans have been majorly frump-tastic on me. If none of the above pan out, I would be willing to revisit the Crew to see if any improvements have been made.

Plan of attack: order the Gap, BR, and Levis. Cross fingers that one or several of those pairs is a winner. If not, move on to the upper echelon of denim. Cross fingers that I don't become hopelessly addicted to overpriced jeans.

Wish me luck!

Labels:

101 in 1001,

americana,

fashion

10 April 2013

Closet Overhaul Update

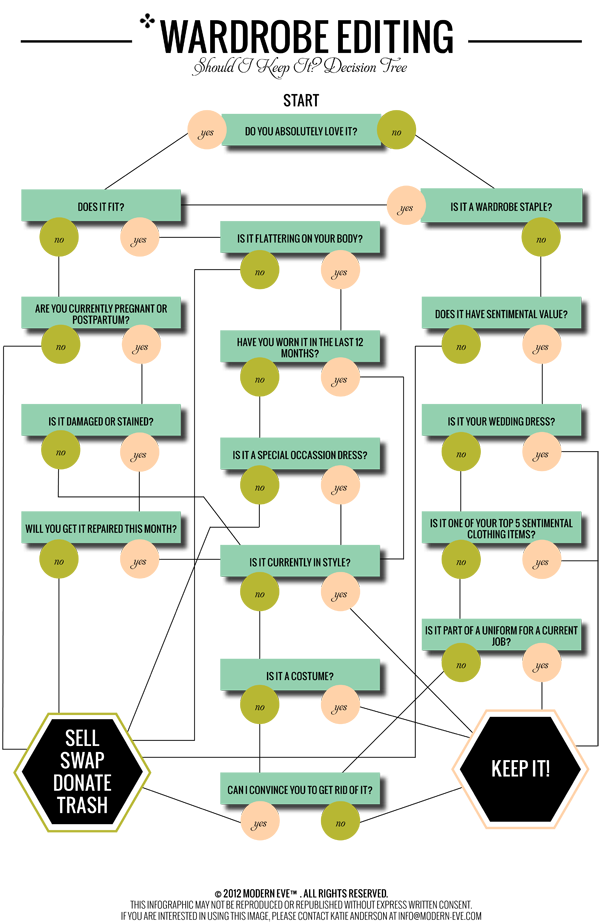

So it happened. Well, it's still happening. The start of the overhaul was shockingly easy and quick. The above stack of clothes were in the toss/donate/sell pile within about 5 minutes because none of them passed the "Do you absolutely love it?" test. That pile was about double in size by the end of the morning and all of those items marched off to a local consignment store yesterday.

Last night I went through my chest-of-drawers and weeded out ancient t-shirts, PJ/lounge pants, and other items that are in decent condition to be donated to the Goodwill. A few things just went straight into the trashcan. My project for tonight is to start the Herculean task of trying on all of my spring clothes that I got out of storage last weekend and giving them some tough lovin'. And then my shoes...that's the part I'm dreading the most.

Still, it felt GREAT to drop off those big bags of stuff at the consignment store and I feel like I still have more brutal honesty in me to narrow down the ranks even more.

Then comes the fun part! Filling my closet with the clothes that I actually need/will wear/will be flattering on me {I'm using the term 'need' loosely here}. The downside to all of that brutal honesty is that my closet looks like I've been robbed. I am pared down to the basics and the items that I love and wear over and over again. At least that's made it easy to identify what I need to purchase. Right now, here's what that list looks like:

pencil skirts {especially in basic colors like khaki, black, and navy}

ankle-length/cropped pants {in all colors and a few fun prints}

long cardigans {in all colors}

button-front shirts {in all colors and patterns}

sleeveless shift dresses {in all colors and patterns}

work-appropriate jackets/blazers

work-appropriate jackets/blazers

several pairs pantyhose in a color very close to my skin tone

jeans {2-3 pairs}

fun blouses {work-to-weekend}

skinny belts

black pumps

black flats

nude pumps

play clothes {a.k.a. weekend wear}

Any one out there have favorite brands/styles of these items? Petite readers: have you found any jeans that work for you? Jeans are my enemy. You can't have them hemmed more than a 1/2 inch because they don't taper or flare properly. It seems like every pair of designer jeans I try on is made for tall ladiezz. Suggestions? I used to love shopping, but now I kind of get exhausted thinking about it. Any help in narrowing down the selection would be tres helpful!

play clothes {a.k.a. weekend wear}

Any one out there have favorite brands/styles of these items? Petite readers: have you found any jeans that work for you? Jeans are my enemy. You can't have them hemmed more than a 1/2 inch because they don't taper or flare properly. It seems like every pair of designer jeans I try on is made for tall ladiezz. Suggestions? I used to love shopping, but now I kind of get exhausted thinking about it. Any help in narrowing down the selection would be tres helpful!

Labels:

101 in 1001,

at the office,

fashion,

goals,

nest feathering,

shoes

09 April 2013

Hiking and Picnicking

Last Sunday was the first real spring day we've had, so we packed up the dogs and headed for the nearest state park. It turns out that hiking with two extremely curious dogs makes for very full hands, so the above pictures were the only ones I managed to get.

But fortunately some people on the interwebs were kind enough to share their photos, so you can see how beautiful it was! We want to go back without the pups so we can tour that gorgeous historic home on the property. That view made the burning I felt in my legs all day yesterday totally worth it.

We also packed a picnic, but we were too busy scarfing down our lunch to be bothered with pictures. I made these sandwiches

{they were just OK}

and brought these chips {the best chips EVER and made not too far from where we live!}

{BBQ for him, Chesapeake Crab for her}

and packed it all up in this nifty picnic cooler set. My mother-in-law gave us one of these Picnic Time Malibu

and packed it all up in this nifty picnic cooler set. My mother-in-law gave us one of these Picnic Time Malibu

It felt so great to be outdoors again and to do something active {read: something other than watch DVR'd reruns of 'The Americans'} on a Sunday afternoon. I can't wait to go back again, especially since all this hiking will come in handy for quickly approaching bikini season!

Labels:

101 in 1001,

A Day in the Life,

fitness,

flowers,

food,

gifts,

healthy living,

pets,

things i heart

04 April 2013

The Great Closet Overhaul of 2013

One of the items on my 101 in 1,001 is to be able to better define my aesthetic in fashion. In order to do that, I need to tackle another item on the list, which is to scrutinize the contents of my closet and donate, store, or toss the items I never wear. To take it a step further, I also need to identify which looks work for me and which looks don't and I need to make a list of what clothing items I need to purchase.

As I mentioned yesterday, my wardrobe is in major need of an overhaul. I'm a classic example of the first world problem of too many clothes and nothing to wear. Here's my MO: I see something cute/trendy/on sale, I'm too lazy to try it on in the store so I buy it, try it on at home, it's not really that flattering but I never get around to returning it. Or I try it on in the store and ignore the fact that it's not all that flattering because it was cute/trendy/on sale and buy it anyways. Then it hangs in my closet after one or two wears {in which I confirm that it is definitely not flattering} and taunts me. Or {my worst habit} I buy work pants that need to be hemmed because I'm such a shorty and they never get to the tailors. Seriously, I currently have 5 {!!} pairs of pants that fit this definition, some of which were purchased 3 years ago. {Here's where I hang my head in shame.}

I also have a hard time parting with my poor-decision purchases because I think, "Well, I spent the money on them, so I should keep them." Of course, this logic is ridiculous. The money is spent whether or not I keep the items in question. So that brings us to today. My goal for this weekend is to truly clean out my closets. That means try on EVERYTHING. Be brutally honest with myself about what looks good and what doesn't. About what I love and what I don't. About what I will ACTUALLY wear and what I won't. There will be four piles: Keep. Donate. Toss. Repair/Alter/Clean.

Then comes {for me anyways} the really hard part: following through. I have to actually take the Donate pile to the Goodwill. I have to bring myself to toss the clothes that are not fit to be donated. And most important, I have to take those clothes in need of some TLC to their appropriate places by Memorial Day weekend.

I have to say I'm invigorated and excited just thinking about this. I don't know what it feels like to open my closet door and not feel a lot of guilt because 90% of the items in there aren't being worn. But I'm also majorly nervous because I'm a little afraid I won't be willing to be as harsh as I need to be. Do you have any advice for me? I know that for everyone of you who's a closet hoarder like me, there have got to me some expert closet editors out there!

I'll be back next week with the results...

Labels:

101 in 1001,

A Day in the Life,

fashion,

goals,

nest feathering

01 April 2013

Menu Monday

FINALLY getting a Menu Monday post up on an actual Monday! Victory!

Thai Chicken Pizza {Culinary Couple}

Why are you reading this? You should be whipping this up for yourself RIGHT NOW. I know M was a little skeptical when he saw Thai chicken pizza on the menu and honestly, I was a little worried too. That was ridiculous because this has now won a space on my favorite weeknight meals list. It's that good. Go make it. FYI, I used my favorite crust recipe from Budget Bytes. Her recipe says it makes 3 crusts, but it only makes 2 in my experience.

Orecchiette with Turkey Sausage and Broccoli Rabe {Everyday Italian}

I used the recipe that is in the Everyday Italian cookbook, so I'm not sure what's going on with the tomato sauce recipe here. It's definitely not in the book. I loved this with 2 caveats: you do NOT need 3 tablespoons of olive oil. More like 1 tablespoon MAX. And 2 bunches of broccoli rabe would be fine, but it would make this recipe more of a broccoli rabe and sausage dish with a little pasta thrown in. That's not necessarily a bad thing, but what you see about was only with one bunch of broccoli rabe and it was plenty. Made enough for excellent leftovers!

Chicken Rollatini with Zucchini and Mozzarella {Skinnytaste}

Major yum. We will definitely be having this again. It came together much faster and easier than I thought it would and it was WAY more flavorful than I was expecting. Also a major hit with M. Two of these little guys apiece + a side salad was more than enough for dinner.

Potato Sourdough Bread {Southern Living 1995 Annual Recipes}

EHRMAHGAWSH. SO GOOD. These two loaves came out of the oven around 5:30pm yesterday and half a loaf is already gone. There is just nothing better than the smell of freshly baked bread. My mom's tips: Only add 1/6 cup {eyeball half of a 1/3 cup} of sugar, otherwise it's far too sweet. Start out only adding 5 cups of flour; you can always add more, but you can't take it out. I used about 5 1/3 cups + what I used to knead the bread {approx. another 1/3 cup}. You don't HAVE to knead the bread, but you get more of a cake-texture without kneading. I would actually knead it a little more than the recipe calls for to get a true bread texture. Honestly, I was surprised how simple this was to make. I'm planning to make another two loaves this weekend and once I feel like I've mastered it, I'm going to attempt cinnamon bread! Yummmmmmmmm.

Labels:

101 in 1001,

food,

menu monday

29 March 2013

Friday Favorites

It's been so long since I did a Friday Favorites post! I hope to be back to regular posting soon. Here's what's on my radar this week:

So I have an addiction. It's strange, because I really hate the regular Peeps. I get grossed out just thinking about them. But these...these are amazing. True story: I drove to three stores earlier this week looking for them so I could have one on my lunch break. NO SHAME.

I spend a fortune each week on grocery store basil and cilantro. I'm determined to overcome my black thumb this summer and grow them at home. I bought seeds and little starter indoor growing cups at Target this week and I'm going to plant them this weekend. This article has some good tips on successfully growing basil and this one is all about cilantro; do you have any other tips for me? I'm going to need all the help I can get. I am a plant murderer.

So you can get the top dress from the normal J.Crew website for $88, or you can get the bottom dress from the J.Crew Factory website for $54.50 plus another 30% off with the code MOREPLEASE. No brainer.

Recipe is from the 1995 Southern Living Annual Recipes cookbook

My parents are coming to visit this weekend and I'm so excited to tackle another item on my 101 in 1,001 list with my mom: making homemade bread! My mother had a sourdough starter that lasted for years and we always had homemade sourdough bread growing up. She recently gave my sister and I the ingredients to make our own starters and this weekend is the moment of truth! My starter's been going for a couple of weeks. I'll report back next week, along with my mom's tips and tricks for theeeee best homemade bread.

For my DC/Baltimore/Northern VA friends and readers, Livingsocial has a fabulous deal going on a 4-pack of tickets to the Virginia Gold Cup races. M and I got our package and would love to see lots of fun people there on the North Rail! Hop to it and let me know if you'll be there!

Happy Easter weekend!

Labels:

101 in 1001,

DIY,

family,

fashion,

food,

friday favorites,

horse races,

sweet treats

06 March 2013

Deal of the Century

One of the items on my 101 in 1,001 list is to invest in 10 coffee table books. I keep a running wish list on Amazon of ones I want to purchase, and the Vogue Living: Houses, Gardens, People and The World in Vogue: People, Parties, Places

and The World in Vogue: People, Parties, Places books have long held a place at the tippy top of that wish list. Earlier this week I learned that a new book had been published, Vogue Weddings: Brides, Dresses, Designers

books have long held a place at the tippy top of that wish list. Earlier this week I learned that a new book had been published, Vogue Weddings: Brides, Dresses, Designers , and I hopped on over to Amazon to add it to my wish list. And stumbled upon this...

, and I hopped on over to Amazon to add it to my wish list. And stumbled upon this...

Your eyes do not deceive you. As of this writing, the boxed set of all three books is selling for $29.55. I repeat, all three Vogue coffee table books, in their entirety, in hardcover, for $29.55. Each book retails for $85, but even if you purchased them individually at Amazon's discounted rates {in the $45-$60 range}, you couldn't find a better deal than this.

Obviously I ordered them immediately. Amazon's pricing is subject to pretty radical change without any notice, so if you've lusted after these books the way I have, now's your chance!

Your eyes do not deceive you. As of this writing, the boxed set of all three books is selling for $29.55. I repeat, all three Vogue coffee table books, in their entirety, in hardcover, for $29.55. Each book retails for $85, but even if you purchased them individually at Amazon's discounted rates {in the $45-$60 range}, you couldn't find a better deal than this.

Obviously I ordered them immediately. Amazon's pricing is subject to pretty radical change without any notice, so if you've lusted after these books the way I have, now's your chance!

Labels:

101 in 1001,

books,

celebrities,

fashion,

gifts,

nest feathering,

parties,

wedding

21 February 2013

On My Bookshelf

just finished

just started

on deck

I really enjoyed The Emperor of All Maladies, Quiverfull, and South of Broad. I was SO surprised at how much I enjoyed South of Broad, because I am not a Pat Conroy fan. Don't get me wrong; there were still multiple point in the book when I wanted to shout, "TOO MANY WORDS!", but overall it was a page turner.

The Emperor of All Maladies was a difficult read. It's filled with a lot of data, a lot of names, and a lot of scientific research. All of it is fascinating and I learned a great deal, but it took me awhile to digest what I had read. That said, I feel like I have a much better understanding of cancer, its history, and its future. Really interesting stuff.

Quiverfull was, in a word, frightening. I enjoyed it and it was incredibly eye-opening, but it also made me sad. It's a book that truly makes you think about religion and forces you to examine the negative aspects of it.

Game Change is the book that the HBO movie was based on, but the book covers a lot more than the epic disaster/SNL miracle that was Sarah Palin. It also focuses on the relationship between the Obama and Clinton campaigns. For a political junkie like me, this book should be a quick read. I can't get enough of stuff like this.

Wolf Hall and The Space Between Us have both been in my Amazon shopping cart for years. I'm ready to finally bite the bullet and read them.

Have any of you read any of these books? I'd be curious to hear your thoughts! Have you read anything good lately that I should add to my ever-expanding on deck list?

Labels:

101 in 1001,

americana,

anglophilia,

books,

Quiverfull

Subscribe to:

Posts (Atom)